N

P

Naveen Pandey

107

investments

Alok Pradhan

275

investments

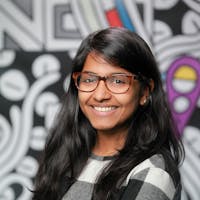

Akrita Kalra

5117

investments

Arvind Sridharan

64

investments

R

K

Rakesh Khemani

1222

investments

Rahul Joshi

151

investments

A

C

Ankur Chandra

253

investments

P

P

Private Profile

1805

investments

Litan Mohanta

2292

investments

M

A

Monu Agrawal

188

investments

Ajay Rungta

301

investments

J

M

Jibanjeet Mishra

276

investments

P

P

Private Profile

304

investments

Ashok Warriar

733

investments

A

R

Arun Raj

42

investments

K

G

Kanika Gulati

126

investments

R

K

Rakhee Kulkarni

150

investments

Pravin Raje

576

investments

R

T

Ravi Kanth Tipparaju

67

investments

Nidhi Bansal Mohta

81

investments

S

S

Srinath Srinivasa

50

investments

S

B

Sai Kiran Bandari

49

investments

R

N

Ramesh Nair

57

investments

R

G

Rohit Gupta

87

investments

Sruti Agarwal

123

investments

Sanjay Deshpande

102

investments

P

P

Private Profile

147

investments

S

C

Sriranganath Chilakamarri

94

investments

S

B

Sandeep Bhatt

57

investments

S

D

Samyuktha Dega

59

investments

R

T

Rose Mary Terry

57

investments

M

D

Manish Dabas

55

investments

R

M

Radhika Mural

5

investments

P

P

Private Profile

94

investments

P

D

Pramit Dash

6

investments

K

A

Kunal Agarwal

194

investments

A

H

Altaf Hussain

81

investments

S

N

Srikanth Nagaraja

106

investments

Vinodkanna Seshadri

25

investments

Arka Dutta

52

investments

Abhishek Dhasmana

599

investments

p

d

prajakt deshpande

52

investments

Gokul Subramaniam

66

investments

R

V

Rajesh Verma

3

investments

P

P

Private Profile

58

investments

S

T

Sreekanth Tangirala

22

investments

T

G

Tinniam V Ganesh

244

investments

H

V

Harshit Vaish

17

investments

FAHMIDA BANO

29

investments

S

S

Satish Srirama

76

investments

N

R

Narasamma Subramanyam Raju

82

investments

V

S

Vijay Bharti Salwan

19

investments

Ayoosh sharma

63

investments

D

U

Danish Umair

78

investments

P

P

Private Profile

113

investments

P

P

Private Profile

85

investments

S

K

Surjit Singh Khattar

74

investments

A

H

Amit Huria

43

investments

P

P

Private Profile

284

investments

H

S

Hemanth Shenoy

194

investments

D

K

Dr. Rajesh Kumar

97

investments

Som parkash

99

investments

P

P

Private Profile

5

investments

S

M

Shray Mehandiratta

180

investments

K

A

Kawalnain Singh Aroroa

92

investments

P

P

Private Profile

58

investments

P

P

Private Profile

15

investments

Rakesh Ahuja

104

investments

V

L

VENKATADHRI L C

95

investments

M

F

Melvin Fernandes

57

investments

S

C

Sarthak Choudhary

24

investments

H

K

H Murali Krishna

365

investments

P

P

Private Profile

98

investments

P

P

Private Profile

111

investments

P

P

Private Profile

280

investments

D

S

Deepak Shenoy

57

investments

P

K

Partha Naresh Kumar Katta

122

investments

V

V

Ved Vadera

276

investments

R

R

Rathindra Nath Roy

183

investments

S

S

Sarvesh Kumar Sinha

35

investments

A

D

Anil Doon

117

investments

k

s

krishna suvarna

111

investments

Gaurav Bhatnagar

70

investments

P

P

Private Profile

340

investments

B

J

Benjamin Joseph

181

investments

Aziz Sattani

125

investments

W

S

Woncy Sharma

110

investments

P

P

Private Profile

174

investments

P

P

Private Profile

41

investments

P

P

Private Profile

169

investments

Vinod Sinandi

145

investments

N

P

Nitin B Pathak

25

investments

Amit Ajmera

48

investments

P

P

Private Profile

104

investments

A

s

Ajeet singh

78

investments

P

P

Private Profile

149

investments

P

P

Private Profile

189

investments

R

k

Rita khanna

24

investments

s

s

sushil singh

73

investments

A

S

Akansha Srivastava

125

investments

S

B

Soniya Balram

47

investments

P

P

Private Profile

80

investments

V

M

Velayudam Mudaliyar

181

investments

P

P

Private Profile

60

investments

H

B

Hemant Bhatt

776

investments

S

G

Sameer Garde

91

investments

Hemant Gujral

49

investments

Madras Ravi Kumar

192

investments

P

P

Private Profile

120

investments

A

R

Avinash Rudrabattla

86

investments

P

K

Pradeep Kuckian

92

investments

D MOHAN Rao

116

investments

P

P

Private Profile

1574

investments

P

P

Private Profile

56

investments

Basavaraj patil

19

investments

P

P

Private Profile

23

investments

R

T

Rashmi Tallpragada

221

investments

P

K

Pooja Kamath

47

investments

A

D

Avantika Dureha

66

investments

Bajrang Lal Dugar

385

investments

A

D

Anjali Daniel

86

investments

Anup Painginkar

15

investments

R

B

Rashi Bhatia

83

investments

Nivedita N

48

investments

P

P

Private Profile

84

investments

Nitish Kanetkar

32

investments

P

P

Private Profile

114

investments

P

P

Private Profile

40

investments

Prashanth VG

38

investments

shiben roy

282

investments

S

B

Shahjahan Bano

139

investments

S

S

Sourabh Sagar

71

investments

Sangeeta Gangwar

223

investments

T

M

Tapesh Mittal

309

investments

P

C

Pramit Chanda

30

investments

Akil Nayak R

100

investments

S

M

Shikha Maria

37

investments

Bhawna Sharma

51

investments

Mahesh Sreenivasan

72

investments

D

B

Dileep Buddaraju

77

investments