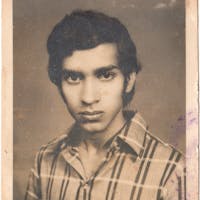

About Ateek

Ateek Khan is a hardworking man who has been repairing cycles in the district of Bahraich for the past ten years. This work requires skill and perseverance, and he has both of these qualities. Now, he wishes to expand his business and make his repair shop a large, and establish a successful business. He is looking to take a loan to buy new cycles, tyres for them, cycle rims, and other expenses for his new and upgraded repair shop. Invest in Ateek Khan as he wishes to lead a better life with his family with the profit from his repair shop.