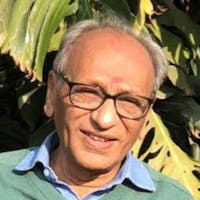

About Kaushal

Kaushal has been doing embroidery for about 3 years now, and she has made a name for herself in the embroidery business. Her hard work, perseverance, and creativity are key factors to her success. With the assistance of this loan, Kaushal will be able to purchase more materials and tailoring machines that she needs to develop her business. Kaushal will also be able to expand her business by enrolling other members of her family to help her with the embroidery. Kaushal's hard work and determination will get her great rewards. Have your share in supporting Kaushal's mission to develop herself and impact other people by contributing to the growth of her family's embroidery business.