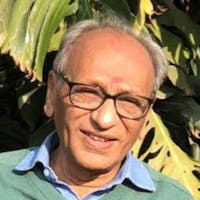

About Komal

Komal is an experienced farmer. She has toiled on her farm for eight years. Komal lives with a family of five and agriculture brings in the income to sustain themselves. There are times when the going gets tough but Komal never backs down. Due to a disruption in the supply chain, she finds it difficult to get essential supplies for beginning the new Kharif season. With this loan, she will be able to buy quality seeds and fertilizers and it also will support her family through this crisis. Invest in Komal and help her tide through these trying times.