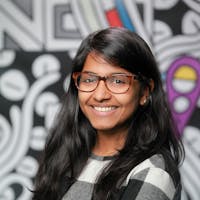

About Madhuri Arun

Madhuri is a hardworking lady who lives in Beed. She runs the family farm. For many years, the family has worked tirelessly tilling the land and tending to the animals. She feeds the animals fresh grass and nutritious fodder. With the assistance of this loan, Madhuri will be able to buy a new buffalo and more fodder to feed the animals. Eventually, she plans to increase milk production so that she can make more money. Invest in Madhuri's family to help her build a secure future.