Chandni Sawlani

162

investments

A

A

Atul Agarwal

279

investments

Akrita Kalra

5117

investments

K

G

Kamal Govindraj

3118

investments

Rahul Walawalkar

2479

investments

Subri M V

1042

investments

A

G

Ashish Gulati

443

investments

A

J

Ankit Jain

148

investments

P

N

Pinal Naik

71

investments

R

R

Ramesh Rajamani

151

investments

K

S

Kamlesh Shankar

354

investments

Atin Kumar

63

investments

P

P

Private Profile

4360

investments

H

S

Harshada Shangarpawar

139

investments

P

K

Praveen Kumar V

125

investments

G

B

Ganesh Baliga

581

investments

P

P

Private Profile

239

investments

G

P

Girish Sadashiva Pai

158

investments

Shashidhara Kumaraswamy

104

investments

Sanjay Varma

1016

investments

P

P

Private Profile

567

investments

D

R

Dinesh Rao

202

investments

V

P

Vinayak Pai

92

investments

Gaurav Pal

154

investments

R Krishna

416

investments

TVS Sasidhar

29

investments

Meenal Mamdani

349

investments

S

T

Santosh Tibrewal

67

investments

Dheeraj Pande

180

investments

P

P

Private Profile

737

investments

P

S

Parneet Soni

70

investments

R

M

Rohit Mallya

91

investments

P

P

Private Profile

181

investments

Priyank Gupta

87

investments

Avi Sanadhya

178

investments

P

P

Private Profile

78

investments

Amrudesh Santhanam

47

investments

Rakshit Bhandari

436

investments

Mitesh Shanbhag

269

investments

Rohit Guglani

21

investments

J

J

Jayakumar Janakiraman

36

investments

P

P

Private Profile

95

investments

V

R

Vivek Ranjan

69

investments

N

R

Nishit Ranjan

87

investments

J

R

Janani Ravichandran

220

investments

P

P

Private Profile

676

investments

Shripad Joshi

125

investments

P

P

Private Profile

128

investments

Gladson Joshua

25

investments

P

P

Private Profile

94

investments

A

R

Anand Kumar R S

484

investments

P

S

Prachi Sakpal

76

investments

Sagar Vasudev

132

investments

Bvdv Prasad

44

investments

B

G

Buddhadeb Ghoshal

123

investments

P

P

Private Profile

141

investments

M

M

Mani Maity

92

investments

V

T

Venkata Prasanth Tummala

121

investments

Vamshi Palreddy

40

investments

K

D

Kaushik Das

360

investments

A

J

Ashok Kumar Jagadeeswaran

133

investments

Pari Bhandari

146

investments

A

L

Aarti Latkar

39

investments

R

S

Rajavel Subramanian

450

investments

H

R

Harsh Vardhan Roongta

264

investments

A

D

Ankur Dassani

466

investments

P

P

Private Profile

216

investments

Rajesh Sengamedu

424

investments

Kalpana Thakur

114

investments

M

K

MANISH KHANNA

19

investments

P

P

Private Profile

36

investments

A

K

Abhishek Khetan

112

investments

Madhukar Raju

142

investments

Bithika Roy

67

investments

S

S

Sandeep Sharma

329

investments

Riteesh Mididoddi

99

investments

P

P

Private Profile

212

investments

P

P

Private Profile

58

investments

P

P

Private Profile

502

investments

S

J

Suman Jayan

244

investments

S

A

Shahnaz Ali

624

investments

P

P

Private Profile

60

investments

N

V

Neelima V

38

investments

D

N

Deepa J Nair

57

investments

P

P

Private Profile

193

investments

Ayoosh sharma

63

investments

s

a

swati anand

16

investments

V Srinivasa

151

investments

S

B

Supriya Berry

167

investments

TANU BHATT

45

investments

Kasul Sheshagiri

372

investments

J

L

Joseph Lewis

120

investments

Jay Shree

454

investments

D

M

Dr.GURMEL SINGH MOUJI

77

investments

M

H

MD MOJAHIDUL HAQUE

84

investments

A

G

Anindya Ghosh

47

investments

P

P

Private Profile

12

investments

P

P

Private Profile

429

investments

Namita Kulkarni

121

investments

Manish Kumar

592

investments

A

K

Abhirath Krishna Kumar

1489

investments

Niraj Bhatt

32

investments

Madan Kore

268

investments

P

P

Private Profile

768

investments

Vudaya Vemuluru

110

investments

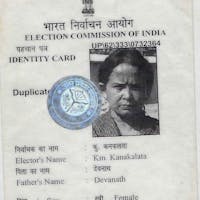

Kanaklata Devnath

349

investments

Bharat Garg

1055

investments

C

C

Chaitanya Choudem

245

investments

P

P

Private Profile

487

investments

L

.

Lets Do Some Good Foundation Trust .

181

investments

Jatin Visaria

30

investments

P

P

Private Profile

25

investments

A

N

Ashish Negi

102

investments

Gajendra Badodekar

58

investments

V

K

Vir Kullar

72

investments

Miroojin Bakshi

367

investments

D

R

Dhakshinamurthy Ramadurai

134

investments

S

V

Somesh Verma

87

investments

Bajrang Lal Dugar

385

investments

Aditya Eranki

7

investments