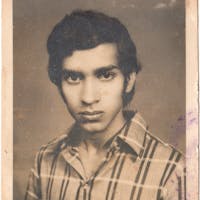

About Manorama

Manorama is a skilled tailor from Niwari, Madhya Pradesh. She has been working hard in her tailoring shop to make ends meet. This loan will help her purchase some additional cloth material and stitching items to spice up her business. She will also decorate her shop well as this is the festival season. She will also be able to find new customers who want to wear customized clothing. Through this loan, she will be able to give hope to work even better and improve her living standards. Invest in Manorama now!