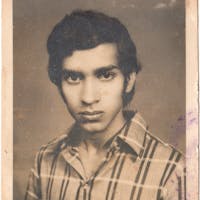

About Mira

Mira Bai is a hard-working woman who never shies away from making efforts to achieve her goals. Mira's husband, like many others in this area, is a farmer who relies on his animals to sustain their livelihood in the form of milk, which in turn generates income for the family. While her husband is busy in the fields and other areas, Mira uses her free time to take care of her animals and provide the necessary attention that the animals need to grow. Mira is committed to doing whatever it takes to ensure that her family is properly provided for. This loan will be used to buy more animals; her husband's business will expand, providing them with a solid financial foundation for the future.