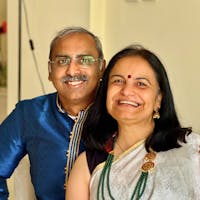

About Mukesh

Mukesh from Khandwa is survived by his wife and 2 kids. He is into goat rearing activity for the past 4 years and manages to run his family with the income he gets from this activity. He will purchase goat kids, nurture them and provide them with healthy food and shelter. Once the goat kids are of good weight, he will sell them in the market, during the festival season and earn some profit. This extra income will help him to save some amount for his future expenses. He is not able to contribute the amount for the goat purchase and hence requests a loan. He will also set aside a part of the loan for building shelter for the goat kids. Invest in Mukesh's loan requirement today and motivate him to succeed in his goal.