Sunil D'Monte

1165

investments

Akrita Kalra

5117

investments

Rahul Walawalkar

2479

investments

A

B

Amit Baldwa

1794

investments

Sandeep Narang

446

investments

H

P

Hirak Patel

302

investments

Sudeep Reddy Konatham

770

investments

Litan Mohanta

2292

investments

V

P

Vineet Pathak

197

investments

P

P

Private Profile

4360

investments

Chaitanya Nadkarny

285

investments

R

M

Raghu Mittal

26

investments

M

S

Mannu Shivaram

555

investments

Ashok Warriar

733

investments

Anindita Basu

81

investments

Vinayak Ram

935

investments

Neeraj Sinha

537

investments

Ram Gopalan

318

investments

A

G

Ajay Gupta

79

investments

Saharsh Khaitan

599

investments

P

P

Private Profile

970

investments

P

P

Private Profile

490

investments

Abhishek Dhasmana

599

investments

Ruth DCosta

279

investments

Nirmal Topiwala

165

investments

A

C

Ajit Chandgude

521

investments

S

A

Shahnaz Ali

624

investments

H

K

H Murali Krishna

365

investments

M

N

Manish N

346

investments

A

M

ANJANA MEHTA

538

investments

P

P

Private Profile

429

investments

A

K

Abhirath Krishna Kumar

1489

investments

P

P

Private Profile

364

investments

H

B

Hemant Bhatt

776

investments

Atul Shinghal

359

investments

Ankita Chhabra Suri

104

investments

P

P

Private Profile

768

investments

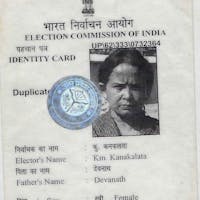

Kanaklata Devnath

349

investments

s

b

suresh bahirsheth

952

investments

Ramanujam S

3493

investments

B

J

Bhaskar Jayaraman

431

investments

Mansoor Ahmad

905

investments

P

P

Private Profile

167

investments

Ganesh Narayanasamy

187

investments

P

P

Private Profile

121

investments

R

T

Rohit Tandon

11

investments

Sandeep Nimmagadda

101

investments

V

M

Vishnu Madhvarayan

2

investments

D

C

Deepika Chandra

44

investments

deepak singhal

161

investments