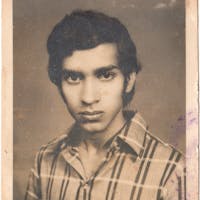

About Snehlata

Snehlata is a resident of Niwadi city in Madhya Pradesh and has two years of experience in the business of making packaging boxes for sweets. Every year she produces some artisan sweet boxes, and her hard work has brought her great success. This year, she has requested a loan from Rang De to upgrade her production capacity and expand her business. With your support, she will be able to purchase raw materials and increase the production of sweet boxes. She will sell the boxes in the city, which will increase her monthly income. Support her now!