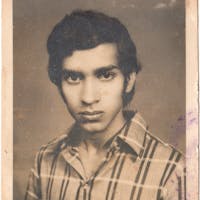

About Subhash

Subhash is a part of the apparel stitching business where he stitches men's apparel and earns a huge profit. Subhash has ambitions to expand his business by laying out new ways of reaching out to his customers and establishing a strong clientele. However, he is lacking the funds to meet his credit needs. With the support of this loan, Subhash will be able to purchase a tailoring machine and other essential items for his tailoring business. This way he will be able to take up more orders and deliver them on time. He will also use some money to decorate his shop. Invest in Subhash to run his business successfully!