Frequently Asked Questions

- About Rang De

- How does Rang De work?

- Investing on RangDe.in

- Repayments & Interest Rates

- NRIs & OCI card holders

Frequently Asked Questions

What is Rang De's mission?

Rang De is on a mission to revolutionize credit access and enable financial inclusion for every individual in India. We are focused on providing affordable and timely credit access to unbanked individuals in the country. To know more about us, visit rangde.in/about/our-story.

What is unique about Rang De?

Rang De is India's pioneering and only peer to peer lending platform focused on providing timely and affordable credit to unbanked communities.

Is Rang De a crowdfunding platform?

Rang De is not a crowdfunding platform. Rang De is an RBI regulated peer to peer lending platform.

Individuals lend money towards livelihood and education needs of communities. Individuals who receive

the

loans repay it as per a predefined repayment schedule. This can be either withdrawn or reinvested.

A crowdfunding platform on the other hand primarily raises donations and enables users to do the same

for

specific causes. Crowdfunding of donations is unregulated and does not come under the purview of any

regulator.

Is Rang De an NGO?

No, Rang De is not an NGO. Rang De is an RBI regulated NBFC P2P platform.

How does Rang De sustain itself?

Rang De has adopted a platform as a service business model. We earn our revenues through platform access fees paid by our impact partners. The impact partners pay a one time setup fee at the time of their onboarding and an annual recurring fee. The impact partners pay this fee to gain access to Rang De’s regulated credit platform for their communities. To know more about our impact partners, check rangde.in/faqs/who-are-impact-partners-what-do-they-do.

Is Rang De regulated by RBI?

Yes, Rang De is regulated by RBI.

How is Rang De different from existing P2P platforms?

Rang De provides credit access at the lowest rate, along with flexibility for the investees to choose exactly when and how much they want to borrow.

Have more questions?

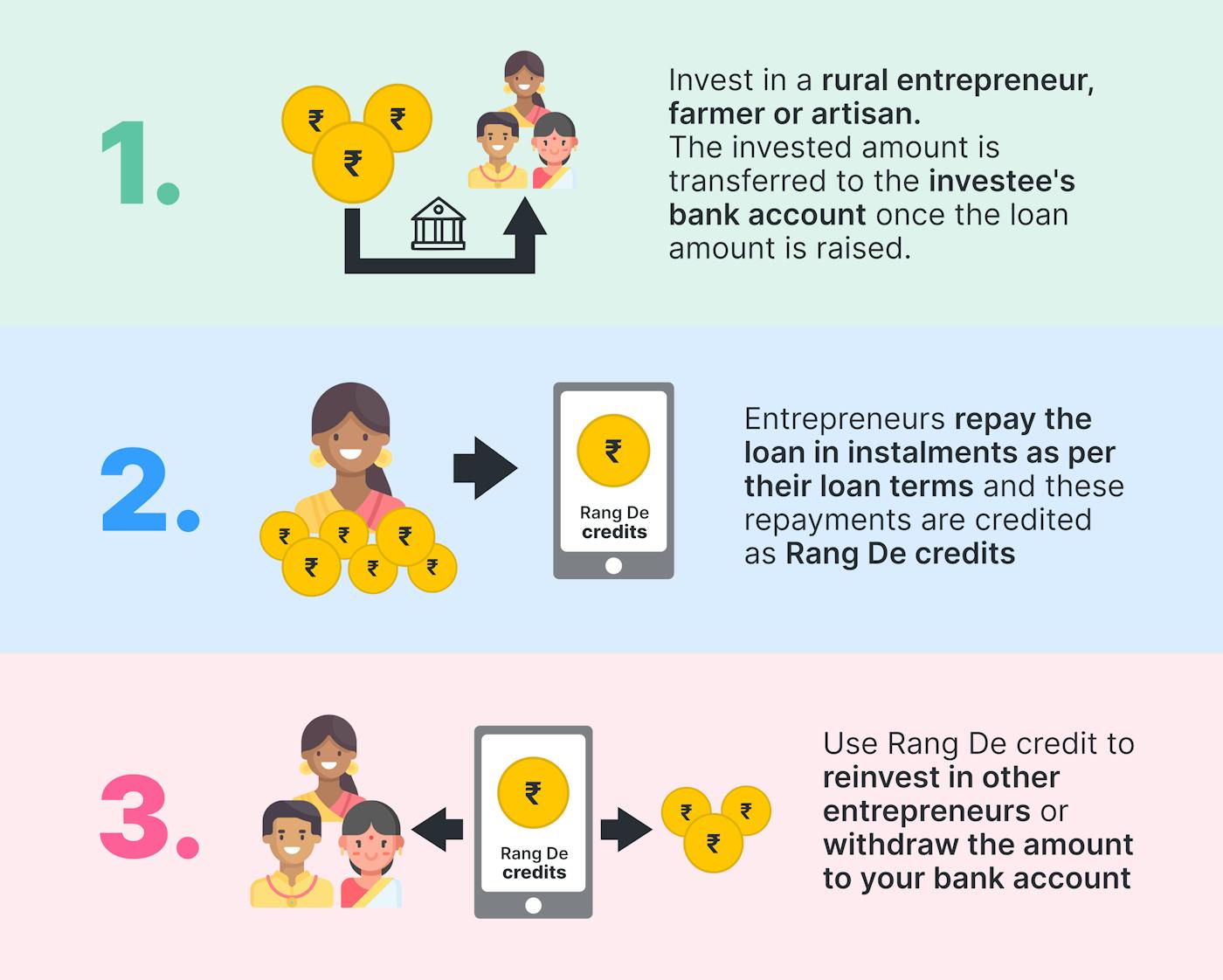

How does the Rang De model work?

Social investors invest in an investee or fund of their choice. Each social investor invests an amount of their choice, starting with Rs. 100. Once a loan is fully funded through these investments, the funds are transferred directly to the investee's bank account. The investee repays the loan according to a repayment schedule, and the social investors receive these repayments in the form of Rang De credit in their dashboard. This credit can be reinvested or withdrawn to the social investor's bank account.

How does Rang De curate investees?

Rang De works with a network of impact partners across the country. These organizations identify individuals who need credit within the communities they work with. To know more about our impact partners, visit rangde.in/know-the-partner.

Who are Impact Partners? What do they do?

Impact partners are credible organizations across the country that work with underserved communities. They empower these communities through entrepreneurship training, capacity building, providing access to markets, and more. Their partnership with Rang De augments their work by providing credit access to these communities. To know more about our impact partners, visit rangde.in/know-the-partner.

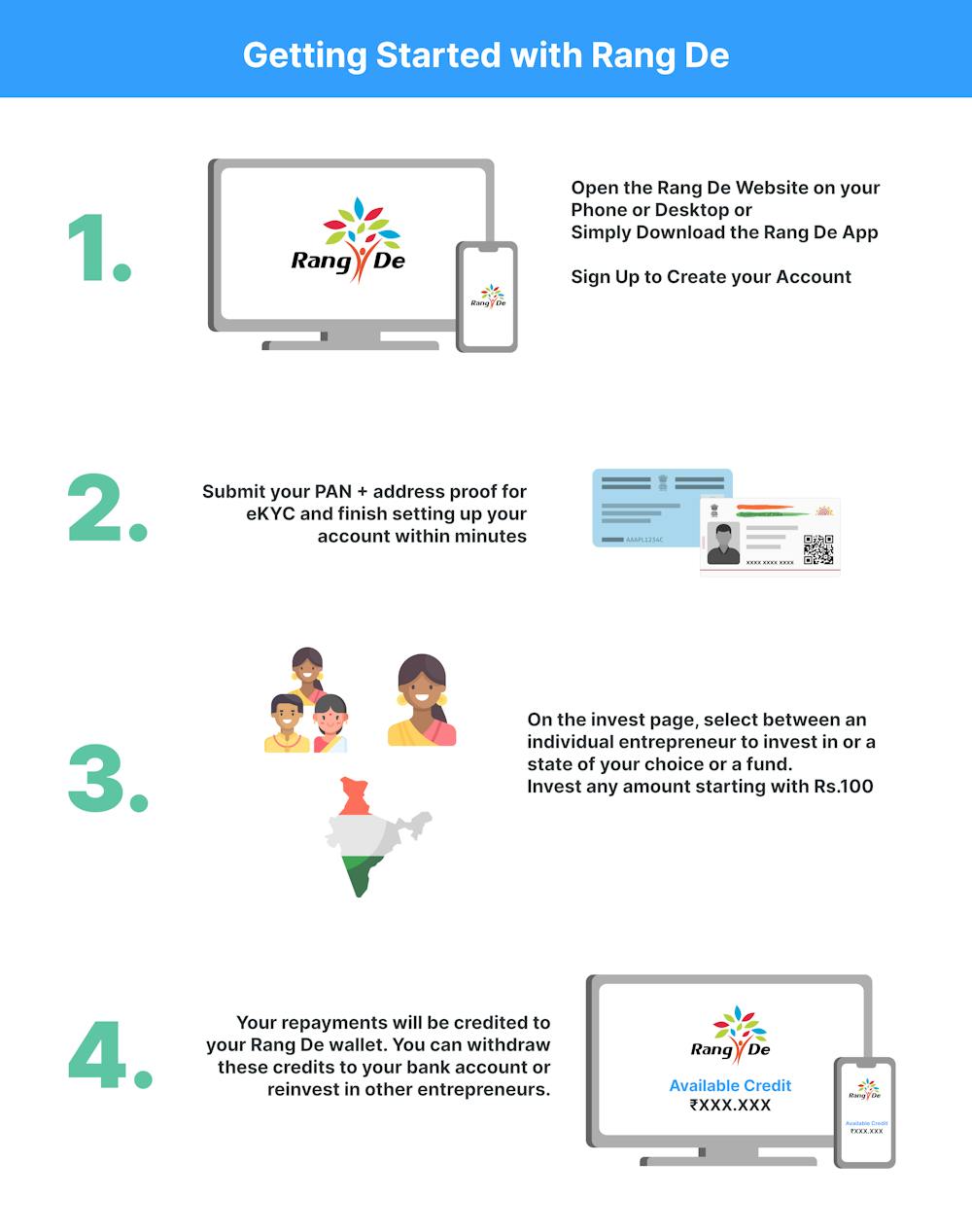

How do I make an investment?

You can make an investment in 3 simple steps:

- Choose an investee or fund to invest in

- Enter an amount to invest

- Make the payment

You can find all investees and funds on rangde.in/invest

What are the payment options to make an investment?

You can pay using debit card, net banking, UPI, or any wallet such as Mobikwik, Phone Pe,

etc.

You can also make a payment using a credit card. However, this cannot be done directly- you have to

use

your credit card through any of your existing wallets such as Mobikwik, Phone Pe, etc.

What is the minimum investment I can make?

You can invest as little as Rs.100 on Rang De.

What is the maximum investment I can make?

You can invest upto Rs.50,000 in an individual investee. You can invest a total of upto Rs.50,00,000 across different investees or funds on the platform.

Where can I track my investments and repayments?

You can track all your investment and portfolio related details through your dashboard.

What is KYC? Why is it needed?

KYC (Know Your Customer) is the mandatory process of verifying your identity. RBI prohibits us to disburse your investment to any investee unless your KYC is complete. This helps us ensure that only verified social investors use our platform.

I can see many loans that are partly funded. Will all of them get fully funded?

Rang De ensures that 100% loans listed on the platform get fully funded. The loans are prioritized according to the urgency of the credit requirement of the investee.

How can I withdraw my money?

You can withdraw your money from your dashboard. to any Indian bank account. The money will be transferred to your bank account within 1 day. There are no extra charges for this process.

Do I receive a formal loan agreement for the investment made on Rang De?

Yes, you will receive a loan agreement for each of your investments. You may download the copy from your dashboard. View a sample copy of the loan agreement here.

How does Rang De ensure that I get my money back?

Rang De works with a set of credible and ethical community organizations or social enterprises called impact partners. These organizations identify communities engaged in sustainable livelihoods, but do not have access to institutional credit. They mentor these communities in effectively utilizing and repaying this credit, leading to an excellent repayment rate on Rang De. However, as per RBI regulations, we cannot guarantee any repayments on the platform. To know more about our repayment statistics, visit rangde.in/track-record

How much interest will I earn if I invest?

You can earn 4% - 6% per annum through your investments. Your returns vary across different investees and funds that you invest in- these are visible upfront in the investee or fund details before and during investment.

Are investments on the Rang De platform taxable?

Yes, the interest earned on investments made on Rang De are taxable in the year of receipt.

Rang De does not deduct any tax at source since the loans are on a peer to peer basis. We provide an

interest certificate at the end of each financial year, which will help you assess your tax liability.

We recommend that you consult your tax advisor to assess your tax liability.

Can I invest as an NRI or OCI card holder?

Yes, we accept investments from NRIs and OCI card holders. The investments must be made in Indian currency through an Indian bank account.

What are the KYC requirements for NRIs and OCI card holders?

The KYC requirements for Resident Indians (RIs) and Non-Resident Indians (NRIs):

- A copy of your PAN card.

- A copy of a valid Indian address proof, which can be any of the following:

- Aadhar card

- Driving License

- Passport

- Voter ID

The KYC requirements for OCI Card Holders:

- A copy of your OCI card.

- A copy of your PAN card.

- A copy of your local address proof of residence.

Please ensure that the documents are clear and legible to facilitate a smooth verification process.

What are the payment options for NRIs and OCI card holders?

We accept payments in Indian currency from Non Resident Rupee accounts maintained with Banks in India. RBI regulations do not permit us to accept payments from overseas Bank accounts or international cards issued overseas.

If I am a NRI, how can I invest through Rang De?

NRIs can invest through Rang De by signing up and completing their eKYC process. You will need your PAN and Indian address proof for the eKYC process.

How can I invest through Rang De as an OCI card holder?

If you have an OCI card, you will need your PAN card, your OCI card, and your current residential address proof to complete your eKYC process. After this, you can start investing.

What is the difference between a NRI and OCI card holder? How can I know the correct category as an investor?

A NRI or Non-Resident Indian is someone who is residing outside India and is an Indian citizen. This is usually an individual who has gone abroad for employment or business purposes. If you are an Indian citizen intending to stay outside India for an undefined period of time, you are a NRI.

An OCI card holder is a foreign national of Indian origin who has registered as an Overseas Citizen of India (OCI) under Section 7A of the Citizenship Act, 1955. The OCI card was introduced in 2005 and OCI card holders can live and work in India for an indefinite period.

What are the tax implications for NRIs and OCI card holders?

For NRIs, income earned through investments in India is taxable in India. For OCI card holders, his/her global income is taxable subject to the conditions of DTAA (Double Tax Avoidance Agreement).

What is the difference between social investing as a NRI and an OCI card holder?

Only the documents required in the eKYC process are different. While NRIs need their PAN and Indian address proof, OCI card holders will need their OCI card, their PAN, and their current residential proof to complete this process and start investing.

I am a foreign national. Can I invest on Rang De?

No. As per the RBI (Reserve Bank of India) guidelines, only Resident Indians, Non-Resident Indians, and Overseas Citizens of India/Persons of Indian Origin having valid KYC documents and Indian bank accounts can invest on Rang De.

Can I invest in foreign currency?

No. According to the guidelines set by the Reserve Bank of India (RBI), investing in foreign currencies is not permissible on our platform.

Do I need an Indian bank account to invest?

Yes. You are required to have an Indian bank account. A NRI or OCI requires a NRO (Non-Resident Ordinary) account to invest on our platform.

What is a NRO bank account?

A NRO (Non-Resident Ordinary) bank account is a type of bank account that allows NRIs and OCIs to manage their income earned in India. This account is typically used to hold and manage income generated from sources within India, such as rental income, dividends, pensions, etc.