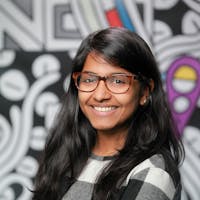

About Geeta

Geeta Devi is currently a representative of her ward council. She is a businesswoman running a farming and animal husbandry business to support her family. She has five years of experience in the farming sector and eight years of experience in the animal husbandry sector and is a pioneer within her community. Her oldest son, owns a truck which is used to provide transportation of the produce of the farming business. His truck has however not been in use since it awaits major repairs and replacement of tyres. Geeta is now seeking a loan to finance the repairs needed for her son's truck. She hopes this will get her business back on track so she can continue saving up to buy a new truck in the future. Geeta is driven by an even bigger dream to become a 'Sarpanch' which is the local village leader to represent her small community to help bring about changes to benefit the residents. Support Geeta as she rises for her community.