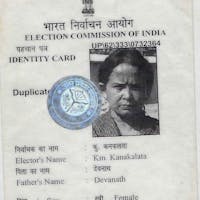

About Kuni

Kuni, a resident of the Koraput district of Orissa, lives with her husband and practices farming for four years to earn a living for the family. As the new season is around the corner, Kuni wants to purchase good quality seeds and fertilizers and employ labourers on the farm. She is determined to explore better farming opportunities so that she could enhance their family income and hopefully build a new house someday. Invest in Kuni and support her fulfill her dreams.