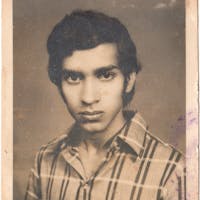

About Rupesh

Rupesh Prajapati is a resident of Niwari, who sells various snacks popular in his region. Customers are not only found near to his food stall but also at a distance. Having more experience in this line of work Rupesh understands how to make the best use of local produce and spices to create innovative and exciting dishes. With your loan support, he will set up the cart, purchase additional materials and spices to expand his business, and serve customers with their favorite snacks and beverages. Contribute towards the growth of Rupesh's food business and also help him serve as a role model for others.