Brahmanand Mohanty

1646

investments

Akshat Srivastava

314

investments

Rahul Walawalkar

2479

investments

Kunal Damle

324

investments

Sandeep Narang

446

investments

H

P

Hirak Patel

302

investments

A

G

Ashish Gulati

443

investments

K

S

Kamlesh Shankar

354

investments

Litan Mohanta

2292

investments

P

P

Private Profile

4360

investments

J

M

Jibanjeet Mishra

276

investments

N

G

Nagendra Grandhi

208

investments

P

P

Private Profile

696

investments

P

P

Private Profile

243

investments

Rakshit Bhandari

436

investments

Indeevar Avnoor

202

investments

S

R

Sunil Razdan

299

investments

Rajdeep Pakanati

212

investments

P

P

Private Profile

676

investments

P

T

Pranav Tiwari

368

investments

P

P

Private Profile

255

investments

N

.

N V LAKSHMI FOUNDATION .

367

investments

Y

T

Yatish Teddla

431

investments

P

P

Private Profile

348

investments

Shashi Gaggar

454

investments

P

P

Private Profile

212

investments

Leena Prakash

194

investments

n

r

nirmal kumar rajachandran

122

investments

P

P

Private Profile

601

investments

Prasoon Mehta

529

investments

P

P

Private Profile

238

investments

Rishikesh Kumar

181

investments

Vaibhav Kapoor

174

investments

Mohammed Abdulmuqeem

59

investments

s

s

sharmila subbiah

124

investments

M

C

MAYUR CHATURVEDI

140

investments

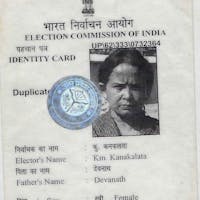

Kanaklata Devnath

349

investments

Ramanujam S

3493

investments

R

T

Rashmi Tallpragada

221

investments

P

K

Pradnya Kulkarni

669

investments

Chelikani Venkata Anirudh Rao

236

investments

U

J

Urvashi Jain

120

investments